food tax in massachusetts

Twenty-three states and DC. All cities and towns in Massachusetts are authorized to adopt a local sales tax upon restaurant meals at a rate of 075 percent.

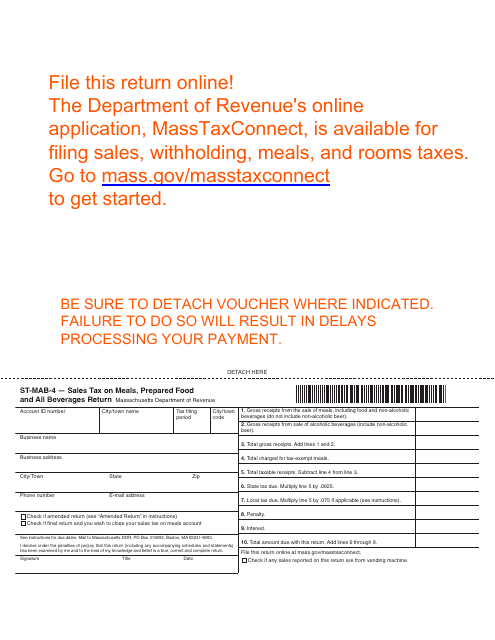

Form St Mab 4 Download Printable Pdf Or Fill Online Sales Tax On Meals Prepared Food And All Beverages Return Massachusetts Templateroller

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

. The tax is levied on the. A restaurant is any. And junk food taxes have shown no negative impact.

This page describes the taxability of. Treat either candy or soda differently than groceries. Monthly on or before the 20th day following the close of the tax period.

Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. SNAP is administered by the Department of Transitional Assistance DTA.

Local Option Meals Excise. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1. All restaurant food and on-premises consumption.

A 625 state sales tax is applied to all items except non-restaurant food and. 2022 Massachusetts state sales tax. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Those who earned more than 100000 or couples earning more than 200000 will get a 100 tax refund per person. Sales tax on meals prepared food and all beverages. Exact tax amount may vary for different items.

40 60 or 80 a month put. Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts. That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate.

Monthly funds on an EBT card to buy food. The base state sales tax rate in Massachusetts is 625. Some 64000 filers or 11 of those who submitted returns.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. A Massachusetts FoodBeverage Tax can only be obtained through an authorized government agency. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Sales Tax on Meals 1 General Outline. Massachusetts has a separate meals tax for prepared food. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by.

The tax is 625 of the sales price of the meal. 830 CMR 64H65. Eleven of the states that exempt groceries from their sales tax base include both candy and.

This page describes the taxability of food and meals in Massachusetts including catering and grocery food. Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

The Massachusetts state sales tax rate. Depending on the type of business where youre doing business and other specific. And junk food taxes have shown no negative impact.

The tax is collected along with. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. State and Local Taxes.

The tax is 625 of the sales price of the meal. Sales Tax on Meals Overview. To find out more about holiday events in Massachusetts check out our Holidays section.

Junk Food Tax Boston Mayoral Candidate John Barros Says Yes Newbostonpost Newbostonpost

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Who Pays Low And Middle Earners In Massachusetts Pay Larger Share Of Their Incomes In Taxes Massbudget

Massachusetts Gives Shoppers Another Sales Tax Free Weekend Wamc

Massachusetts 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tax Free Weekend August 13 14 2022 Mass Gov

Food Tax Repeal Think New Mexico

Tax Amnesty On Table As Senate Unemployment Insurance Bill Amendment Wwlp

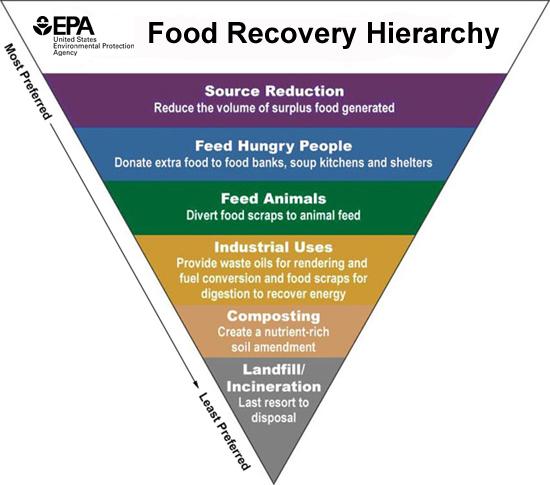

Tax Incentives And Laws Help Recycle Food Recyclingworks Massachusetts

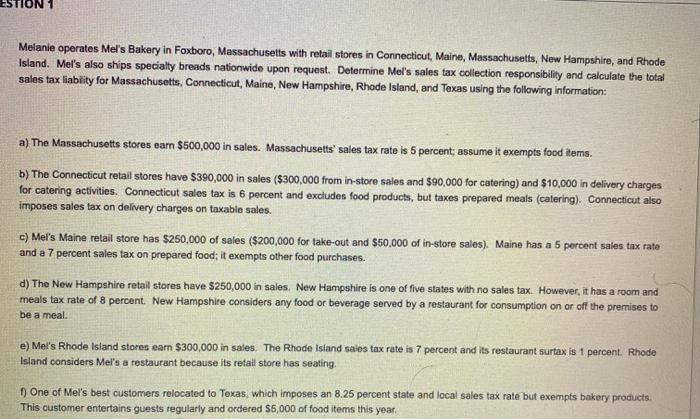

Solved 1 Melanie Operates Mel S Bakery In Foxboro Chegg Com

The N H Mass Tax Fight Could Have Implications That Go Far Beyond Our Borders The Boston Globe

Form St Mab 4 Fillable Sales Tax On Meals Prepared Food And Or Alcoholic Beverages For The Months Of August 2009 And The Months Thereafter

Food Donation Guidance Recyclingworks Massachusetts

Massachusetts Stmab 4 Fill Out And Sign Printable Pdf Template Signnow

Responding To The Covid 19 Crisis Filling Gaps In Federal Cash Support For Individuals And Families By Mass Budget Policy Center Blogs Briefs Medium

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Should Massachusetts Enact A Junk Food Tax The Boston Globe

1 000 Readers Voted Here S How They Feel About A Millionaires Tax In Mass